2006年10月21日

“完美乎? 缺陷乎?” 淺談自由市場經濟

很久沒有寫過關於時事經濟的文章. 近日看見特區政府有意放棄沿用多年的”積極不干預”政策, 令筆者不禁想起香港八, 九十年代賴以成功的自由市場經濟. 所謂的”自由市場”, 一直被公認為最”理想”, 最”完美”的經濟體, 但這個”共識”離事實有多遠呢? 為什麼我們要選擇這個制度呢? 自由市場的”自由”兩字, 指的是什麼樣的自由呢?

首先, 世上有完美的人嗎? 哈~ 當然沒有! 各人有各自的優點缺點, 便是德蘭修女也會有她的缺陷, 那麼由人組成的經濟體, 有可能會達致完美嗎? 答案其實是淺而易見的. 再”完美”的法律制度 (也是由人組成), 也是會出現寃案, 不公的情況; 是故完美的人不存在, 完美的經濟體系也不會存在. 自古以來, “完美”, “理想”等詞語, 均只能追求, 不能實現.

不同人不同組織有不同利益, 那一種政策最能 (或最終趨向) 平衡各方的利益, 那便是最”理想”的政策.

舉一個簡單的例子: 看看你們身邊的交通燈便知道了. 一個人口眾多的城市, 其道路交通是非常繁忙的, 每條道路在每天不同的時間均有不同的流量需要, 情況就如社會上各方面的利益團體 (不論是商界, 中產, 勞工, 福利等), 也是在不同的社會環境下有不同的需求, 每條道路均想追求最大的”暢順度”, 那一條道路不想越少交通燈越好呢? 道路相互交纏, 就如社會各界也繫在一起, 牽一髮而動全身. 你想增加勞工的福利嗎? 那便相對損害了商界的利益, 那一條道路綠燈長開, 另一條路便長期擠塞. 政府的工作, 便如城市的交通燈系統, 維持着各條道路的平衡暢通, 盡量避免一條大道永遠暢通, 一條小徑永遠擠塞的局面. 其實各位只要稍稍想像一下, 也會知道那是一種多麼複雜的系統, 而我們的社會, 明顯地, 比交通系統又不知複雜多少倍.

舉一個簡單的例子: 看看你們身邊的交通燈便知道了. 一個人口眾多的城市, 其道路交通是非常繁忙的, 每條道路在每天不同的時間均有不同的流量需要, 情況就如社會上各方面的利益團體 (不論是商界, 中產, 勞工, 福利等), 也是在不同的社會環境下有不同的需求, 每條道路均想追求最大的”暢順度”, 那一條道路不想越少交通燈越好呢? 道路相互交纏, 就如社會各界也繫在一起, 牽一髮而動全身. 你想增加勞工的福利嗎? 那便相對損害了商界的利益, 那一條道路綠燈長開, 另一條路便長期擠塞. 政府的工作, 便如城市的交通燈系統, 維持着各條道路的平衡暢通, 盡量避免一條大道永遠暢通, 一條小徑永遠擠塞的局面. 其實各位只要稍稍想像一下, 也會知道那是一種多麼複雜的系統, 而我們的社會, 明顯地, 比交通系統又不知複雜多少倍. 筆者是推崇佛利民所創立的新古典經濟學派 (簡稱芝加哥學派) 的. 與一般人的常識不同, 我們是理所當然地認為多點交通燈, 交通的秩序便會越好; 而芝加哥學派所倡的, 是交通燈越少越好. 的而且確起初會引起混亂, 但混亂過後, 便會達致一個效率極高的”秩序”.

筆者是推崇佛利民所創立的新古典經濟學派 (簡稱芝加哥學派) 的. 與一般人的常識不同, 我們是理所當然地認為多點交通燈, 交通的秩序便會越好; 而芝加哥學派所倡的, 是交通燈越少越好. 的而且確起初會引起混亂, 但混亂過後, 便會達致一個效率極高的”秩序”.在佛利民的成名著作”Free to Choose”中已清楚帶出上述的訊息. 由於政府身為執政者, 是很難對各界的利益團體作出切身的體會及選擇, 是故歷史上, 能作積極主導而有大成效的政府實在少之有少, 反之導致社會失衡的例子倒多如恒沙星數. 新古典經濟學派提出的, 是以市場作主導的經濟體, 比較起政府規劃的經濟體, 在產權清晰界定的情況下, 所造成的社會資源浪費是最少, 效用最高. 這是本港學者張五常教授的老調了. (詳情可參考張教授的著作”賣桔者言”)

是故現今自由市場經濟體系的普及, 究其原因, 是由於所造成的資源浪費最少, 能將有限的社會資源作最大的發揮, 但另一方面, 其體系的缺點絕對是不可忽視的. 其中最明顯的, 便是在激烈競爭下所造成貧富懸殊. 其實這真的有點矛盾, 資源有限 (地球是這麼大便這麼大), 自由市場經濟模仿自然界千百萬年進化所用的”物競天擇, 適者生存”制度運作, 不停將弱者淘汰改善自身質素, 並將身邊資源作最大的效用, 減少浪費, 但老天開了人類一個大玩笑: 賦予我們感情, 當看見弱者被淘汰時, 我們不禁心懷憐憫, 問: “他們沒過錯啊~不過能力比人弱, 罪不至死啊!”, 這句話在我們心中喊出來時, 永恒的矛盾便造成了. (小圖為Charles Darwin, 著作"Natural Selection")

是故現今自由市場經濟體系的普及, 究其原因, 是由於所造成的資源浪費最少, 能將有限的社會資源作最大的發揮, 但另一方面, 其體系的缺點絕對是不可忽視的. 其中最明顯的, 便是在激烈競爭下所造成貧富懸殊. 其實這真的有點矛盾, 資源有限 (地球是這麼大便這麼大), 自由市場經濟模仿自然界千百萬年進化所用的”物競天擇, 適者生存”制度運作, 不停將弱者淘汰改善自身質素, 並將身邊資源作最大的效用, 減少浪費, 但老天開了人類一個大玩笑: 賦予我們感情, 當看見弱者被淘汰時, 我們不禁心懷憐憫, 問: “他們沒過錯啊~不過能力比人弱, 罪不至死啊!”, 這句話在我們心中喊出來時, 永恒的矛盾便造成了. (小圖為Charles Darwin, 著作"Natural Selection")儘管我們透過自我完善的機制, 例如實施福利政策保障被淘汰出來的人們, 但在西方世界實施了近四, 五十年的今天, 很明顯看到其福利政策的遺禍之大, 以及其尾大不掉的恐怖……說實話, 自由市場經濟相較大家想像中的”完美”, 實在是有點距離的.

儘管如此, 在想不到有其他更佳取代制度前, 筆者是贊同芝加哥學派的. 另外很有趣的是, 一般人誤以為自由市場經濟中的”自由”, 指的是政府沒需要存在, 任由社會各界自我調整, 自發自動運行似的. 沒錯, 芝加哥學派是提出”大市場, 小政府”政策, 但並沒有表示政府不必存在的可能性以及其影響的重要性. 交通燈的確是越少越好, 但並不表示它應該消失!

在現今的市場經濟, 完全自由是不可能的, 在資訊革命的推動下, 全球經濟越趨緊密, 形勢千變萬化, 那難得形成的”平衡經濟”轉眼間便可能給打亂重整, 為了維持”平衡局面”的穩定性, 政府的干預是必要的. 例如面對過度的通漲及通縮, 政府便可以透過調整滙率應對. 是故政府的干預, 雖少但重要, 而且應集中在整個體系的框架上. 至於體系本身的運行, 則越少干預越好.

在現今的市場經濟, 完全自由是不可能的, 在資訊革命的推動下, 全球經濟越趨緊密, 形勢千變萬化, 那難得形成的”平衡經濟”轉眼間便可能給打亂重整, 為了維持”平衡局面”的穩定性, 政府的干預是必要的. 例如面對過度的通漲及通縮, 政府便可以透過調整滙率應對. 是故政府的干預, 雖少但重要, 而且應集中在整個體系的框架上. 至於體系本身的運行, 則越少干預越好. “Free to Choose”的名字起得好, 自由市場經濟中的”自由”, 指的是個體的自由選擇, 並不是指無政府狀態的”自由”. 沒有健全的法律制度, 有效的政府管治, 自由市場經濟是難以建立的.

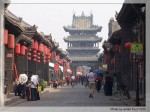

很多人誤以為只有西方民主世界才能建立自由市場, 其實不然, 自由市場經濟與本身的政治體制其實是沒多大關係的. 便是處於皇權獨裁的清代中國, 山西的平遙便是當時全國的”金融”中心, 小小縣城有廿二間票號, 佔國家一半的票務生意, 其分號更開遍天下, “晉商”二字名震古今. 清初的金融業得以蓬勃發展, 很大程度有賴康熙乾龍營造的太平盛世, 政局穩定, 並實行寬鬆的經濟政策, 原來早在兩百多年前, 清政府便對經濟實行”積極不干預”政策, 結果在市場經濟的運作下, 造就了山西平遙的經濟奇蹟. (比香港早了一步呢, 哈哈~).

很多人誤以為只有西方民主世界才能建立自由市場, 其實不然, 自由市場經濟與本身的政治體制其實是沒多大關係的. 便是處於皇權獨裁的清代中國, 山西的平遙便是當時全國的”金融”中心, 小小縣城有廿二間票號, 佔國家一半的票務生意, 其分號更開遍天下, “晉商”二字名震古今. 清初的金融業得以蓬勃發展, 很大程度有賴康熙乾龍營造的太平盛世, 政局穩定, 並實行寬鬆的經濟政策, 原來早在兩百多年前, 清政府便對經濟實行”積極不干預”政策, 結果在市場經濟的運作下, 造就了山西平遙的經濟奇蹟. (比香港早了一步呢, 哈哈~). 當年平遙大行: 日昇昌號的總店橫匾, 刻了一句”匯通天下”, 便充分顯示了自由市場經濟的威力! (相信不少香港人也熟悉這一句吧~)

附註: 近日找到年屆九十四歲的佛利民一篇關於香港的文章, 一句"Although the territory may continue to grow, it will no longer be such a shining symbol of economic freedom"成為經典, 真的是花無百日紅, 憑着天時地利人和創造經濟奇蹟的香港, 經過近三十年的高峰, 也許是時候落幕了. 現將原文輯錄如下:

Hong Kong Wrong

By MILTON FRIEDMAN

October 6, 2006; Page A14

It had to happen. Hong Kong's policy of "positive noninterventionism" was too good to last. It went against all the instincts of government officials, paid to spend other people's money and meddle in other people's affairs. That's why it was sadly unsurprising to see Hong Kong's current leader, Donald Tsang, last month declare the death of the policy on which the territory's prosperity was built.

The really amazing phenomenon is that, for half a century, his predecessors resisted the temptation to tax and meddle. Though a colony of socialist Britain, Hong Kong followed a laissez-faire capitalist policy, thanks largely to a British civil servant, John Cowperthwaite. Assigned to handle Hong Kong's financial affairs in 1945, he rose through the ranks to become the territory's financial secretary from 1961-71. Cowperthwaite, who died on Jan. 21 this year, was so famously laissez-faire that he refused to collect economic statistics for fear this would only give government officials an excuse for more meddling. His successor, Sir Philip Haddon-Cave, coined the term "positive noninterventionism" to describe Cowperthwaite's approach.

The results of his policy were remarkable. At the end of World War II, Hong Kong was a dirt-poor island with a per-capita income about one-quarter that of Britain's. By 1997, when sovereignty was transferred to China, its per-capita income was roughly equal to that of the departing colonial power, even though Britain had experienced sizable growth over the same period. That was a striking demonstration of the productivity of freedom, of what people can do when they are left free to pursue their own interests.

The success of laissez-faire in Hong Kong was a major factor in encouraging China and other countries to move away from centralized control toward greater reliance on private enterprise and the free market. As a result, they too have benefited from rapid economic growth. The ultimate fate of China depends, I believe, on whether it continues to move in Hong Kong's direction faster than Hong Kong moves in China's.

Mr. Tsang insists that he only wants the government to act "when there are obvious imperfections in the operation of the market mechanism." That ignores the reality that if there are any "obvious imperfections," the market will eliminate them long before Mr. Tsang gets around to it. Much more important are the "imperfections" -- obvious and not so obvious -- that will be introduced by overactive government.

A half-century of "positive noninterventionism" has made Hong Kong wealthy enough to absorb much abuse from ill-advised government intervention. Inertia alone should ensure that intervention remains limited. Despite the policy change, Hong Kong is likely to remain wealthy and prosperous for many years to come. But, although the territory may continue to grow, it will no longer be such a shining symbol of economic freedom.

Yet that doesn't detract from the scale of Cowperthwaite's achievement. Whatever happens to Hong Kong in the future, the experience of this past 50 years will continue to instruct and encourage friends of economic freedom. And it provides a lasting model of good economic policy for others who wish to bring similar prosperity to their people.

P.s. Mr. Friedman, the 1976 Nobel laureate in economics, is a senior research fellow at Stanford's Hoover Institution.

The comments are closed.